Mildly Infuriating

Home to all things "Mildly Infuriating" Not infuriating, not enraging. Mildly Infuriating. All posts should reflect that.

I want my day mildly ruined, not completely ruined. Please remember to refrain from reposting old content. If you post a post from reddit it is good practice to include a link and credit the OP. I'm not about stealing content!

It's just good to get something in this website for casual viewing whilst refreshing original content is added overtime.

Rules:

1. Be Respectful

Refrain from using harmful language pertaining to a protected characteristic: e.g. race, gender, sexuality, disability or religion.

Refrain from being argumentative when responding or commenting to posts/replies. Personal attacks are not welcome here.

...

2. No Illegal Content

Content that violates the law. Any post/comment found to be in breach of common law will be removed and given to the authorities if required.

That means: -No promoting violence/threats against any individuals

-No CSA content or Revenge Porn

-No sharing private/personal information (Doxxing)

...

3. No Spam

Posting the same post, no matter the intent is against the rules.

-If you have posted content, please refrain from re-posting said content within this community.

-Do not spam posts with intent to harass, annoy, bully, advertise, scam or harm this community.

-No posting Scams/Advertisements/Phishing Links/IP Grabbers

-No Bots, Bots will be banned from the community.

...

4. No Porn/Explicit

Content

-Do not post explicit content. Lemmy.World is not the instance for NSFW content.

-Do not post Gore or Shock Content.

...

5. No Enciting Harassment,

Brigading, Doxxing or Witch Hunts

-Do not Brigade other Communities

-No calls to action against other communities/users within Lemmy or outside of Lemmy.

-No Witch Hunts against users/communities.

-No content that harasses members within or outside of the community.

...

6. NSFW should be behind NSFW tags.

-Content that is NSFW should be behind NSFW tags.

-Content that might be distressing should be kept behind NSFW tags.

...

7. Content should match the theme of this community.

-Content should be Mildly infuriating.

-At this time we permit content that is infuriating until an infuriating community is made available.

...

8. Reposting of Reddit content is permitted, try to credit the OC.

-Please consider crediting the OC when reposting content. A name of the user or a link to the original post is sufficient.

...

...

Also check out:

Partnered Communities:

Reach out to LillianVS for inclusion on the sidebar.

All communities included on the sidebar are to be made in compliance with the instance rules.

view the rest of the comments

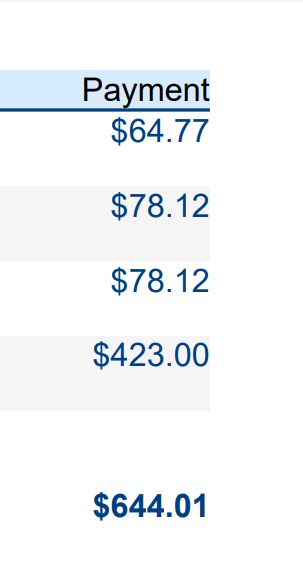

Sometime last year I felt some lumps in my scrotum. worried it could be a sign of balls cancer, I went and had them checked. I have probably better health insurance than most people i know. Cost about the same. Outrageous. but hey, turns out i don't have balls cancer so i guess it could be worse.

It could also be better. I don't think that there is any Western industrial nation outside the US, where this wouldn't be fully covered by your statutory insurance.

Hey! I did this same thing! Also cost about 6 or 700

Well, good for you. Some people do have ball cancer and don’t have $644 to confirm it.

It sucks. Damned if you do, damned if you don’t.

And there’s a lot of people who have to live with ball cancer because even if they could afford to confirm it, they couldn’t afford to treat it. And that’s a decision people make every damn day.

Hell, I have a well-paying job and decent insurance and I still have to decide when my kids cough is bad enough to merit a sick visit to his pedi knowing that it’ll cost $250.

One of my kids had an ear infection right before his annual well visit (which is covered). They did his hearing screening as part of the well visit and it was covered, but he failed due to sinus congestion left over from the cold.

So we came back for a re-test. Still congested, still failed. Come back again in a couple weeks.

Couple weeks later we come back and he passes.

Few more weeks later we received bills for $250 for each of the followup hearing tests.

The whole system is fucked.

My youngest child needs speech therapy because he's nonverbal and should be stringing full sentences together by now. Speech therapy is entirely coinsurance based so I have to pay $95/appt until I reach the $2000 deductible then I'll be paying ~$20/appt

These appointments are biweekly and started in November. I had a long conversation with both insurance and the therapy office to clarify my options. I found out the therapy office charges only $65/appt if you don't go through insurance, reduced the appointments to weekly, while reducing all other spending I could to stretch it out, then come end of the year (open enrollment) I maxed out the flexible spending account at $3k for the year and verified the new year didnt drastically change the insurance coverage. I still had to lean on wealthier family to help me pay for everything but pretty soon we should hit the deductible and it'll (hopefully) be smooth sailing from there.

I'm also thinking I should setup a HSA and toss some of the tax return in there when that arrives as another line of defence. My wife tends to treat our checking account as the "available budget" so I've taken to shuffling money into various other accounts as that's far easier than fighting to get her to manage money better

Preface, I am not an accountant. This is my perspective and you’re welcome to take the advice or not.

The benefit to HSA is that it’s funded with pre-tax money (same as FSA, but HSA rolls over year to year and usually balance over a certain amount is able to be invested into some mutuals/etfs).

Big benefit of FSAs is that they are pre-funded at the start of the year with pre-tax fake money. So that’s there for you for the whole year (just make sure it’s all used up by the end). Think of it as a 0% line-of-credit that is secured by your salary/job, resets every year, and is paid automatically by pre-tax dollars.

I don’t think you’d be coming out putting your tax refund into an HSA, unless you are counting the post-tax deposit towards this years tax burden. And if you are claiming standard deduction, it may not even give you very much of anything.

If you can float the cash, better to put your refund in a 1yr CD or something. Even into a HYSA, you’d probably come out ahead over an HSA.

Keep in mind you can only contribute to an HSA if you have a HDHP. If you don’t have an HDHP, it’s not an option.

Forgot about this part. I just saw it was an option through my bank and thought it might be a good idea. If the bank one does require being tied to an insurance account then that won't work since my insurance has too low of a deductible to let me get an HSA

HSA only has four requirements for eligibility, but three of them are “you are covered by an HDHP, no other insurance, and not medicare”

https://apps.irs.gov/app/vita/content/17s/37_04_005.jsp?level=advanced

If pre-tax savings is what you’re looking for, FSA is it.

Also if you do day camp or preschool for your kid, there is also DCFSA. They can pay for certain dependent care expenses with pre-tax savings…daycamp, after/before school care, and preschool, are some of the big ones for kids.